Positional investing and reforms in the socio-economic sphere on the example of the pension system in the Czech Republic

Positional investing and reforms in the socio-economic sphere on the example of the pension system in the Czech Republic

Abstract

The paper focuses on the distinction between two types of reforms (or reforms and anti-reforms) using the tools of positional investment analysis:

a) reforms that solve the problem by moving society to a "higher level" of dynamic, environmentally friendly and human-oriented economic development (where the development of human capabilities is the most significant factor of economic growth), in which mutual trust between those who govern the country and those who live in the country grows;

b) anti-reforms ("people's reforms") that block positive changes in the development of society, demotivate the population, exacerbate relations within society, and open up space for positional investment by domestic and foreign lobbies, i.e., space for the transformation of already acquired property and positional advantages into an even greater redistribution of the wealth created in their favour.

Current events in the Czech Republic, using the concrete example of pension issues, allow us to demonstrate the importance of the tools of description and analysis of positional investing to clearly distinguish between reforms and anti-reforms.

1. Introduction

We live in an era when the role of the productive services sector is growing, i.e. services that enable the acquisition, preservation and application of human capital and thus human capabilities, which at the same time act as a source of economic growth and a determinant of its quality , . Civilisational changes in this direction face a number of barriers and require support in the form of reforms based on an analysis of the natural tendencies of social development as a process in which society changes nature and thus itself.

One of the most important barriers to prospective changes in the economic and social spheres is positional investment. Current development in the Czech Republic in the area of preparing, discussing and advocating changes to the pay-as-you-go pension system make it possible:

- To show some important aspects of prospective changes in the economic and social sphere.

- To distinguish between reforms and anti-reforms in this area.

- To demonstrate the role of positional investment tools and tools of its analysis in distinguishing reforms and anti-reforms.

- To use the tools of analysis to document real events and to predict future development.

- To gain valuable insights applicable to pension reforms and downstream social investment and social insurance systems in other countries.

Focus on distinguishing between two types of reforms (or reforms and anti-reforms) using the tools of positional investment analysis:

1. Reforms addresses the problem by moving society to a "higher level" of dynamic, environmentally friendly and human-centered economic development (where the development of human capabilities is the most significant factor in economic growth) in which mutual trust between those who govern the country and those who live in the country grows.

2. Anti-reforms (or, as the academic D. S. Lvov called them, ""man-eating" reforms") that block positive changes in the development of society, demotivate the population, exacerbate relations within society, and open up space for positional investment by domestic and foreign lobbies, i.e., space for the transformation of already acquired property and positional advantages into an even greater redistribution of the wealth created in their favor.

Current events in the Czech Republic, using the actual example of the pension issue, allow us to demonstrate the importance of the tools of description and analysis of positional investing (which is the main cause and the most important factor of distortions in social life) to clearly distinguish between reforms and anti-reforms.

Positional investing is the transformation of a property advantage into a privilege, i.e. into a position from which the victim of positional investing can be discriminated against and increase his future property advantage and thus the degree of discrimination. It takes many forms, but its most significant form is the suppression of investment opportunities associated with the possibilities of developing, preserving and exercising the skills of those against whom positional investing operates, so as to promote investment opportunities that depend on positions gained. The most important prevention or defence against the negative role of positional investing is the creation of conditions for equality of opportunity to acquire, preserve and use human capital.

The issue of pensions concerns only one of many areas and one aspect of the way to increase the efficiency of the economic system (services related to the preservation of human skills or human capital), but it is in this area that the most important developments are taking place in the Czech Republic.

2. Research methods and principles

The main tool is the Nash (S, d) model of the bargaining problem extended with a function or line of neutrality of positional investment. This tool is based on insights gained in the field:

- Explaining the paradox that arises in ultimatum games , , , .

- The economics of productive consumption, i.e., an economics in which the goal of consumption is not utility in the sense of enjoyment, but the creation and operation of assets that generate future income, including investing in the development of skills or social positions , .

- The distinction between myopic and nonmyopic equilibria, which is fairly well explored by game theory .

- Using a Nash (S, d) model of the bargaining problem augmented with possible reactions of the other party based on the estimated consequences of the split , .

- Analyses of the role of positional goods in terms of their effect on future income , .

Why is the analysis of positional investing so important? Positional investing is the economic base from which grows what may trigger the decline phase of our civilization. Positional investing:

- Is a more accurate name for the phenomena that in the tradition of Marx's interpretation of reality is referred to as exploitation or alienation.

- It answers the question of what is the source of what we intuitively feel as injustice or consider unjust.

- It describes the mechanisms by which society is segregated, vertical permeability is restricted, and equality of opportunity is eliminated.

- It reveals what has given rise to the mass creation of structures based on the mutual cover-up of violations of generally accepted principles, and what increases the effectiveness of this cover-up.

- It is key to understand how the confluence of position-based structures and mutual coverage of violations of generally accepted principles works.

- It allows us to answer the question of why there has been an interconnection between the power generated from above by the installation of manipulative and blackmailable persons and the rise of structures based on the mutual cover-up of violations of generally accepted principles from below.

- It provides an answer to the question of why there has been a reduction in competition in the field of positional investment, and how the reduction in competition in this field translates into a suppression of competition in the field of entrepreneurship based on investment in production expansion and innovation.

- It provides some support for estimating how compact the spontaneously emerged confluence of structures based on positional investing and the mutual overlapping of generally accepted principles is (i.e. in what sense and to what extent the current global power can be considered as an influencer).

- It is a tool to identify the degenerative process of bringing the increasingly compliant and coerced obedient and the contemporary increasingly constrained into the global hierarchy of the institutional system.

3. Position investing analysis tools

1. The main tool of positional investing analysis - the function or line of neutrality of positional investing is based on Nash's bargaining problem, it is its extension and the original result of the team dealing with the issue.

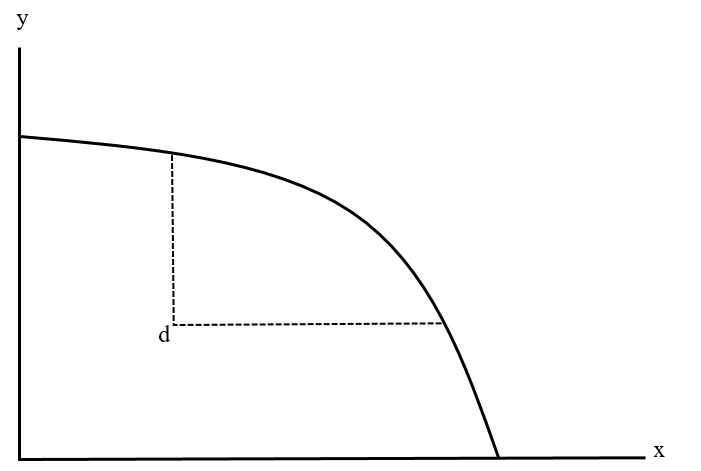

Figure 1 - Graphical representation of the Nash bargaining problém:

x, y - coordinates, which represent the payoffs of each player; S - the set of achievable payoffs bounded by a convex curve; d - the initial situation, we call it the point of disagreement, i.e. the distribution of payoffs in the event that the joint action did not occur

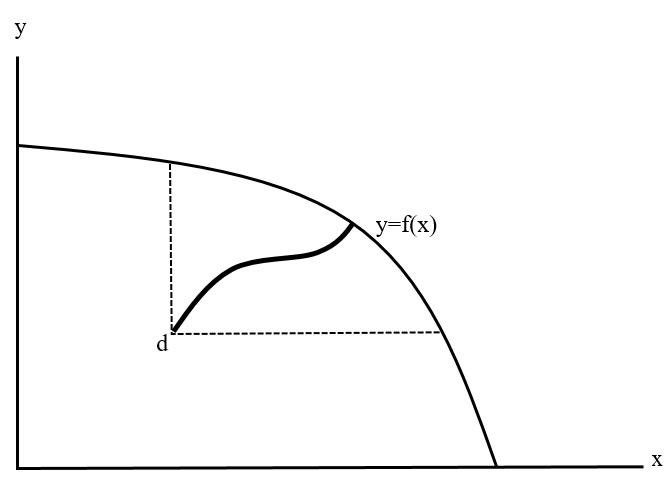

Figure 2 - The positional investment neutrality function

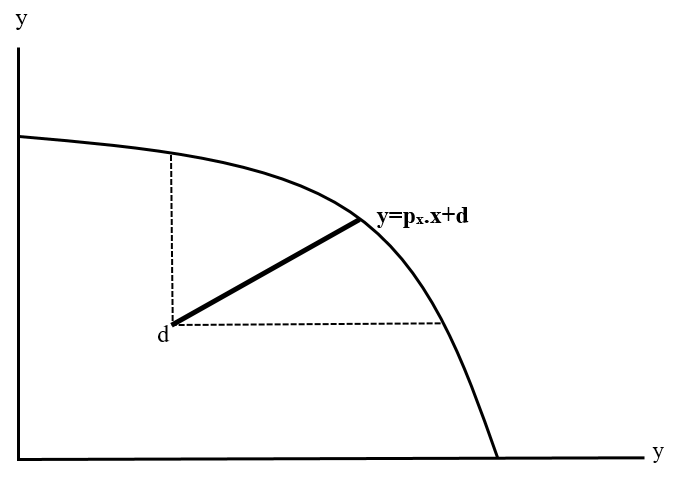

Figure 3 - Position investing neutrality line

To illustrate and make it easier to understand, consider the paradox that arises in ultimatum games. These are experiments in which the experimenter offers the players a certain amount of money (say, 100 crowns) to split in some alternative payoff in ten crowns. One of the players makes the offer, the other either agrees or refuses the split. If they agree, they split according to the proposal; if they disagree, no one gets anything. Offers of a 90 (to the offerer):10 (to the other player) split are rejected in the vast majority of cases, even if the rejecting player loses 10 crowns or more. Statistically, players usually settle for a 60:40 split, but some unconditionally insist on a 50:50 split. Is it just a matter of psychology, e.g. envy or a sense of injustice, or is there a deeper cause that a positional investing model can reveal? It can be shown that the positional investing model gives the best answer. It also implies that subjective feelings (feelings of injustice, envy, unfairness) are derived from individual and transmitted social experience and as such are embedded in decision-making psychological mechanisms without us being sufficiently aware of it. Similar situations may arise in the aforementioned cases of sharing of spoils, results of joint venture/enterprise, in the employee-employer relationship, etc.

In the case of social reforms aimed at stimulating performance and the distribution of the wealth created, consciously or subconsciously, the people affected by the reforms ask themselves: Is the reform in question aimed at improving the functioning of the economy (or at solving a particular problem that needs to be solved), or is it driven by the interests of those who, by virtue of their property superiority, are in a position to influence the behaviour of the government (where the possibly stated need to solve a particular problem is only a pretext) and to further consolidate their positions in future developments at the expense of those who, in the form of anti-reform, are deprived of a larger part of their means of subsistence than before? This is the basic dilemma that most people face in forming their position on reform.

In the implementation of any reform, most people face the dilemma of whether the reform is actually to the benefit of the majority, or whether it is merely a way for lobbies whose influence comes from their wealth superiority to strengthen their positions through the reform. From this point of view, it is worth making everyone aware that there are various possibilities, forms, ways and mechanisms in society for turning a property advantage into an advantage for some and a disadvantage for others. If these possibilities are balanced by creating more or less equal conditions for the development, preservation and exercise of human capabilities, society can develop successfully. If, however, the role of positional investment is systematically reinforced, society is on the road to decline. As we will show, the theoretical tools developed to analyse positional investing make it possible to distinguish reforms from anti-reforms very precisely.

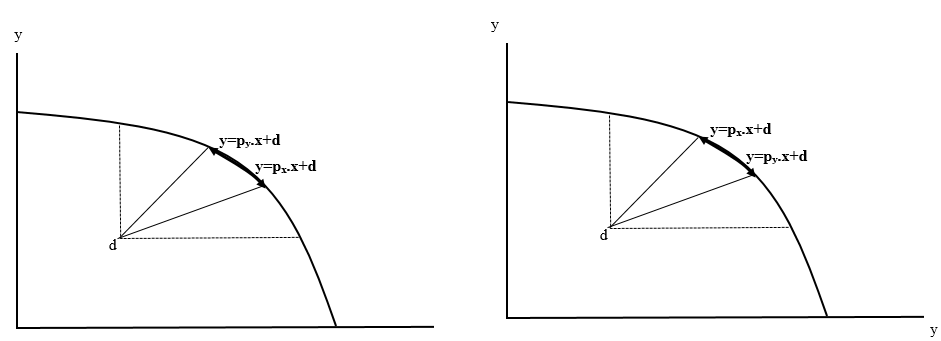

Figure 4 - Two alternatives for different players to see reality differently:

y=px.x+d - the line of neutrality of positional investing as seen by player X; y=py.x+d - the line of neutrality of positional investing as seen by player Y

Note: the subscript of the coefficient p, which corresponds to the slope of the positional investing neutrality line, is decisive

Right part of the figure: If we consider a set that satisfies the assumptions of reachability, individual and collective rationality, then when the minimum guarantee demanded by player Y is satisfied, player X has a smaller payoff, demands to satisfy his minimum guarantee, and vice versa. That is, there is no room for bargaining.

This leads to a first series of general conclusions (which we will make more specific by moving on to the issue of the pension scheme):

1. If there is not to be an escalation of problems in society, reforms must be implemented in such a way that an atmosphere of trust is fostered and the room for negotiation is as wide as possible.

2. Well-designed and cost-effective reforms should push the frontier of achievable payouts towards higher payouts; anti-reforms push the frontier in the opposite direction.

In the case of social reality, and especially in estimating and valuing the future, it is only natural that players see reality differently. No one is omniscient. However, even from the realisation of this fact, a certain conclusion follows: it is important to observe who tries to influence the view of the participants (players) to increase their awareness and rationality, and who prevents this. This is also an important indicator in distinguishing reforms from anti-reforms.

4. General scheme of reforms and anti-reforms – how reality becomes legible

In this section we will interpret a pair of pictures that illustrate the difference (polarity) between real reforms and anti-reforms. We will show that in some cases it is possible to describe reality, including the direction of development, quite accurately through theory. The key is to distinguish between two extreme cases:

1. the situation when the government can to face the pressure of domestic and foreign lobbies, when it is able to fulfill its responsibility for the development of the given country, when the influence of the substantial part of the public, which would be most affected by the opening of the space for positional investment by its negative consequences, is effectively reflected in its policy. In this case, then, the government is proposing reforms that:

- Limit the role of positional investing and create a greater degree of equity for the acquisition, retention and use of human capabilities as the most important determinant of the dynamics and quality of economic growth.

- They increase the efficiency of the economic system.

This is a case of genuine reforms that move society in line with natural development trends.

2. A situation in which the government succumbs to pressure from domestic and foreign lobbies, resigns itself to its responsibility for the development of the country in question, and tries to eliminate the role of the substantial part of the public that would be most affected by the negative consequences of abusing the changes to open up space for positional investment. In this case, the government is proposing anti-reforms that:

- Open up the space for positional investing, of which the government itself becomes an agent, thereby suppressing the possibility of acquiring, preserving and exercising human capabilities as the most important factor determining the dynamics and quality of economic growth.

This is a case of the misuse of reforms that condemn society to decline, hardship and inevitable internal conflicts, which can also mean the disintegration of a country's economy.

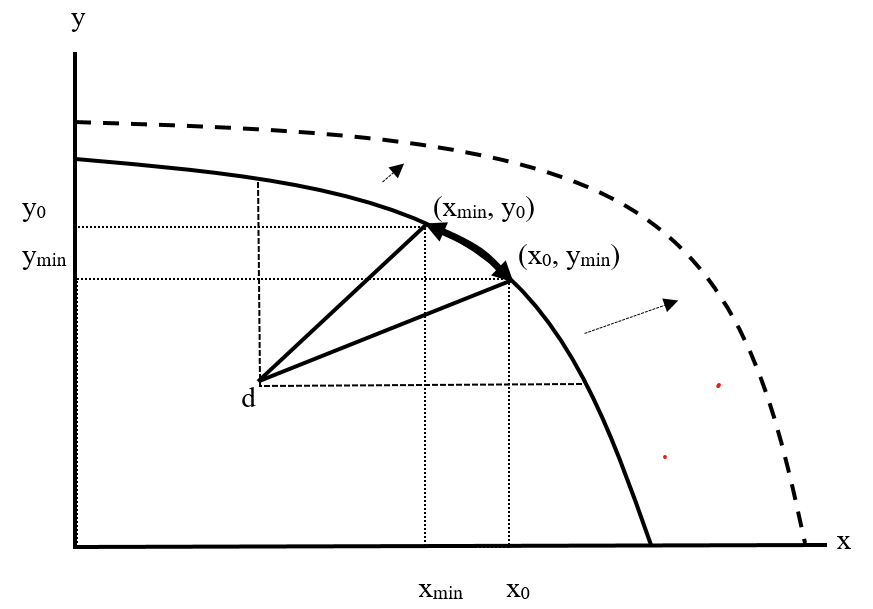

Figure 5 - Real reforms

- xmin is the payoff corresponding to the minimum guarantee required by player X not to fall victim to positional investing by player Y

- y0 is the payout of player Y at this point

- ymin is the payout corresponding to the minimum guarantee required by Player Y to avoid being a victim of positional investing by Player X

- x0 is Player X's payoff at this point.

Since xmin < x0 and ymin < y0 there is room for agreement in this case.

1. Player X (i.e., those targeted by the reforms) sees in them the prospect of increasing the efficiency of the economic system and, consequently, the possibility of increasing their own payoffs.

2. Player X has confidence that player Y (the government) is sufficiently defending the interest of the country in question both from internal and external positional investment.

3. In this case, even if the reforms entail some restriction but also contain the prospect of improvement, he supports the implementation of the reforms.

4. If expectations are at least partially met, this has two positive consequences:

- The efficiency of the economic system grows (or its resilience to the stresses to which it is subjected by external conditions grows, which can be expressed by shifting the frontier of the achievable distribution of payoffs. This is represented in the figure by the arrows and the dashed curve distinguishing the new frontier of the achievable distribution of payoffs from the original one.

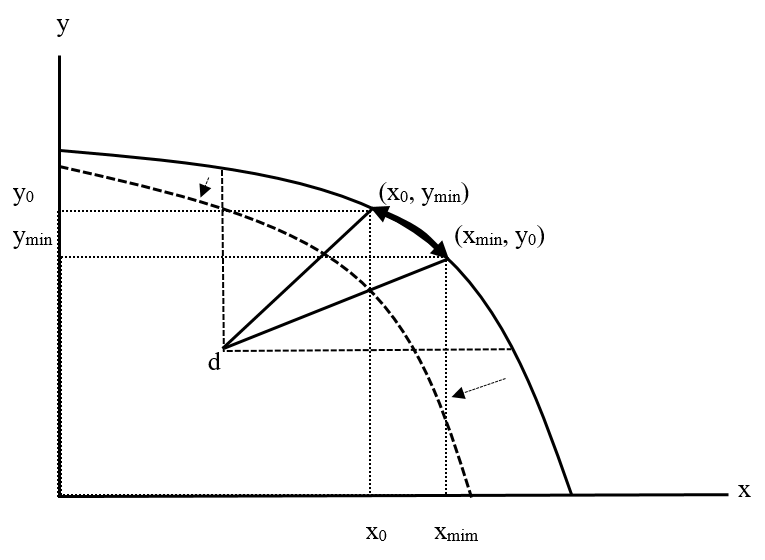

Figure 6 - Anti-reforms

The second case can be interpreted as follows:

1. Player X (i.e., those targeted by the reforms) sees them as a danger of opening up even more room for positional investing.

2. Player X has no confidence that Player Y (the government) is sufficiently protecting the interest of the country in question from both internal and external positional investing.

3. In this case, he/she does not support the implementation of reforms or shows resistance to them.

4. If negative expectations are fulfilled, this has two negative consequences:

- The efficiency of the economic system declines (or its resilience to the stresses to which it is subjected by external conditions declines, which can be expressed by a shift in the limit of the achievable distribution of payoffs. This is represented in the figure by the arrows and the dashed curve distinguishing the new frontier of the achievable distribution of payoffs from the original one.

- The slope of the neutrality lines of positional investing changes in the sense of moving away from the area of agreement. We do not highlight this in the figure in order not to complicate it further. This shift is easy to imagine. Current developments in the Czech Republic show that this aspect is becoming important and that the model will have to be extended in this direction. More on this in the discussion.

If we can find a sufficiently general statement of what is going on in reality, this statement serves us simultaneously as a key to "deciphering" reality, as a tool for "deciphering" reality, as a "reading prism" for understanding what is going on.

In the case of the changes in the pension system, this is the following, truly textbook

polarity:

- Either the path to long-term stability of pay-as-you-go pensions will move towards voluntary, individual, incentivized extensions of the earning power of those who can and want to self-actualize in their profession.

- Or we will go down the road of administrative, disincentivised, compulsory, flat-rate (or administratively modified flat-rate) extension of retirement.

One or the other.

It is not true that pension reform has to hurt. It is possible to follow a path that prolongs a person's full life and fills it with meaning, where even a gradual loosening of professional activities gives a person a sense of satisfaction, the knowledge that he or she is useful to others, and allows him or her to maintain social contacts.

There are huge and unused reserves in the area of:

- Education from the earliest age to the concept of a career path as a long-distance race.

- An education system aimed at developing and preserving the ability to continually update qualifications and to take advantage of the necessary upgrading of qualifications.

- Health care aimed at keeping people mentally and physically fit for as long as possible.

- Cultivating a company culture that positions people for employment at an older age while benefiting the company.

- Supporting measures that enable people in their later years to gradually loosen up their professional activities.

- Building creative intergenerational teams in which older people can find full and effective employment.

The use of the above options depends on the creation of the necessary incentives built into the pension system. The performance of the pension system = its incentive effect for all of the above. An administrative, forced extension of the retirement period leads to the destruction of these incentives and thus to the destruction of the performance of the pension system.

The dispute over reform is not so much about whether and how pensioners will suffer, but first and foremost about whether we will embark on a path towards a new quality of economic growth that can be sustainable, dynamic and unrestricted.

The new quality of economic growth is due to the double effect of productive services, i.e. services aimed at developing, preserving and applying human skills:

- The first effect is due to the fact that consumption, in which productive services play a dominant role, is inherently nature-friendly, as opposed to ostentatious, prestigious, consumerist consumption.

- The second effect is due to the fact that this consumption leads to a significant strengthening of the innovative potential of society, which is an essential and sufficiently influential factor in relieving economic growth from all aspects of environmental and, in particular, natural environmental burdens.

This connection is not obvious at first sight. It emerges when we start to analyse the possibilities offered for extending the productive lifetime, and in particular, apart from the first point, all the other points:

- They form a natural defence against the influence of positional investing.

- They encourage the growth of the role of the productive services sector, i.e. services contributing to the acquisition, preservation and use of human capital.

- At the same time, this changes the nature of economic growth towards dynamic and environmentally friendly growth.

- They contribute to creating equality of opportunity for the acquisition, retention and use of human skills.

This alternative becomes even more evident when we look at the concrete possibilities that can be exploited in the extension of the period of motivated, individual, voluntary extension of the period of productive human employment in the occupational markets in the Czech Republic:

- a set of labour law measures to allow a gradual disengagement from work. The field survey found that a relatively large proportion of employees would be willing to continue working if their employer was willing to reduce their hours. Employers are often interested in proven retirement-age employees but have so far overlooked the possibility of retaining them on a part-time basis. Creating part-time employment opportunities for older people should and could become part of corporate culture and corporate social responsibility.

- Increasing the incentive power of the pay-as-you-go pension system to extend the period of voluntary productive activity according to individual possibilities, while strengthening solidarity between those who want to be productive even at an older age and those who cannot or no longer want to be. This can be ensured by an appropriate transition to a specific form of NDC system. It would even be enough to create a "post-graduate superstructure" of the pay-as-you-go system, which could be entered by people who have reached the age of 65 according to the principle of how much money I put into the system, so much I get back in the form of a life annuity (after deducting a suitably set intra-generational solidarity levy). In principle, it would be possible to extend this superstructure towards the younger years and reform the whole system. This is the long-term basis for the follow-up steps below .

- Motivate health insurance companies and, through them, providers of health and spa services to prolong the physical and mental prerequisites for a person's employability in the professional markets, including the use of spa care and appropriately selected cultural programmes within it (naturally taking into account the specific workload of people in individual professions). This can be ensured by ensuring that part of the over-65s' contributions to health insurance remain in the account of the earner concerned, which can be used to pay for extra health care designed specifically to extend the period of voluntary productive employment. This will also give each health insurer an interest in providing those services that are of interest, including prevention, health monitoring or the provision of spa care. This is so that as many people as possible who are of working age are in the insurance tribe.

- Lifelong learning, including certified courses aimed at upgrading skills (professional, communication, self-care for health, etc.) provided by universities to reflect changes in society. These educational services can also be financed from their economic effects. The whole education system will gradually change.

- Awareness-raising aimed at getting people to think about their entire professional career from childhood onwards, gradually fleshing out their idea of self-fulfilment. The costs in this direction are minimal and can be implemented without delay. If this gradually influences the dominant world view, it will lead to a reduction in the percentage of those who are dependent on funding from the pension system. It is a lifestyle change towards a natural life filled with meaning.

- Growing the role of creative intergenerational teams in the economy as vehicles for innovation potential and as an area of highly economically efficient employment for older people. This, however, presupposes breaking out of the inertia towards society.

5. Who are the players in the current game in the Czech Republic, how is the game evolving and how will it end?

In general, reality can be imagined as a kind of conglomerate of interconnected games, of which each person is only aware of a part. Often, or rather most of the time, he has no idea which of the games is the dominant one, or rather, he overlooks the dominant game.

If we want to analyze any game, we must first of all accomplish the following:

1. To say which game it is (i.e., to classify real events into a particular domain of game theory).

2. Define the players (i.e. define and describe in detail who plays the game in question with whom, what are the preferences of the players).

3. Define the strategies that the players possess.

4. Describe the consequences of different combinations of strategies used.

In most cases, two interrelated types of games are played in the design, approval and implementation of reforms that affect the acquisition, retention and application of human capabilities:

1. between the government and domestic and foreign lobbies that seek to open the way for an increased role of positional investing through change. In any particular situation, each of these players has two strategies:

- The government can either give in to the pressure or face it.

- The lobbies can either increase the pressure on the government or back down.

2. Between the government and the public (usually represented by the opposition or part of the opposition). In any given situation, each of these players has two strategies:

- The government can either give in to public or opposition pressure, or it can counter it.

- The public or the opposition can either increase the pressure on the government or accept the situation.

The government is thus subjected to two pressures, and through it two opposing forces clash. In any particular game, it depends on a number of factors that can be identified and whose influence can be roughly appreciated using and within the framework of the basic concept. On this basis, predictions of further developments can be made, and the most significant moments of conflict that accompany the preparation, adoption and implementation of the type of reforms we have studied can be identified and described.

In the Czech Republic, an unusual and, from the point of view of theoretical analysis, very interesting situation has occurred. The government has completely emptied its position as a mediator between two types of pressures and has become a mere tool in the hands of lobbies, most of which are foreign.

This sets off a game in which the foreign lobby, using the government to promote its strategy, stands on one side, and the public and the opposition on the other. In doing so:

- Foreign lobbies fully control almost the entire institutional system of the Czech Republic (including the intelligence services, the mainstream media and the courts), they are aware of their power and take almost no risks.

- Both the public and the opposition are completely unaware (in many cases not aware at all) of what is going on, or what game is being played.

The Czech Republic is thus facing a very difficult test. At the moment, it is difficult to say how far the situation will go, or how far the country will fall.

The question is how theory, which is equipped with theoretical tools for analysing such situations, can play a role in this situation. Any theory can be successful from a practical point of view if it finds its implementer, but also vice versa if its implementer finds this theory.

This interconnection is not easy for a number of reasons. Because they can work against it:

- Administrative constraints on the part of the part of the institutional system that is dominated by positional investing.

- The control of the communication space by entities linked to positional investing.

- Even the control of the field of science itself (academia) by actors linked to positional investing.

- The tendency of a significant part of the mainstream public to favour the easy paths, which prevents a realistic assessment of real developments, the unification of those who are the greatest victims of adverse developments, the abuse of excesses to link positional investment and the use of instruments of power to hold power.

The main tool of theory in these adverse conditions is to anticipate future developments in the form of short-term predictions, outlining alternatives and identifying turning points in which the alternative prevails.

In doing so, it is necessary to be constantly aware that remedial change can take place in one of two ways:

- Either reformist forces from "above", i.e., from the field abusing positional investing, profiting from positional investing and serving the dominant form of positional investing, will assert themselves. To do this, however, they need allies from "below", i.e. from those who are victims of positional investing.

- Or it can establish itself as the hegemon of change by resisting from below, but for this it needs to gain allies from above.

In this respect, the theory needs to be internally consistent and at the same time appeal to audiences on both sides.

Another important role of theory is to analyse and document real developments in an informed way so that other countries do not find themselves in a similar situation.

In the Czech Republic, very favourable conditions have been created for responding to the easily predictable development of the demographic situation with a complex of active measures leading to the creation of suitable conditions and increased incentives for voluntary individual extension of the period of productive, i.e. gainful, employment of a person in the professional markets. This would raise the economy to a higher quality of economic growth, enable it to increase its dynamics and its "friendliness" both to the real wealth of human life and to the environment.

At the same time, however, a government has been installed (and an institutional system cast) that fully serves foreign lobbies. This has made the Czech Republic a space dominated by positional investment on a transnational scale. This is manifested, for example, by the imposition of a model of dependent export policy on the Czech Republic, which has significantly suppressed a large number of very important investment opportunities at its disposal.

What is happening now in relation to the pension issue can be expressed in the following terms:

1. We know from demographic projections that between around 2030 and 2050, the pay-as-you-go system will face some transitional pressure, where, in order to be sustainable, the number of full-time earners at retirement age will need to increase by almost 20% over the current situation (while earnings increase significantly) within 20 years. This, even with a large margin, can be achieved by a complex of measures that support:

- Motivation to voluntarily extend the period of gainful employment on an individual basis while gradually loosening work activities in line with mental and physical fitness.

- Supporting activities in the areas of company culture, education, health care, etc.

2. The use of these would possibly mean for the Czech Republic:

- Shifting the economy to a higher level in terms of the general direction of the development of society towards the growth of the role of productive services, i.e. services aimed at the acquisition, preservation and application of human skills.

- Strengthening its position in the world and increasing its independence from external pressures.

3. This path was still supported by the Minister of Labour and Social Affairs M. Jurečka in April 2022 (i.e. a year ago) .

4. Those who deal with pension issues at the MLSA know well about the merits of the path based on individual motivations to extend the period of productive employment of a person and its incompatibility with a blanket forced extension of the retirement period, as the relevant analyses have been published in the journal published by the MLSA , .

5. Immediately after the election of P. Pavel as President, the government (and experts associated with it) began to argue that there is only one solution – a flat-rate (only slightly administratively modified) forced extended retirement period, which is totally inappropriate. The existence of the second option has not penetrated the mainstream-dominated media space at all. The Minister of Labour and Social Affairs commented, "There is another measure related to the ageing of society that may cause me to fall out of favour with you, but we must do it. It is a gradual increase in the retirement age. I know what a wave of emotion was caused by one of the proposals that suggested retirement at 68. I understand that. That is why we have decided to proceed as sensitively as possible. The retirement age limit will only be moved if, according to the Czech Statistical Office, life expectancy increases" .

6. The situation in terms of public opinion on a flat-rate extension of the retirement period has not developed favourably for the government, or those who direct it with their instructions. In the medical community in particular, there have been many arguments which have been taken up by the mainstream media. It was only a matter of time before a discussion opened up on the path of individual, voluntary extension of the working life, in the direct context of the long-term development perspective of the Czech Republic. This country has the means to advance to a "level" of higher quality economic growth. This is by means other than the dubious 'greendeal-route/way'. And so a scenario of direct devastation of the pension system was hastily launched. Those who have set this scenario in motion assume that the erosion of confidence in the pension system will make it impossible to consider not only current but also future solutions that offer prospects.

7. To this it should be added that the government has been pushed by its incompetence and external action into a huge budget deficit, and solving the liquidity problem by issuing bonds is associated with the threat of default.

So there is a lot at stake.

The main reason is to prevent the Czech Republic from embarking on a path towards a better future, which could be started by a comprehensive reform of the pension system, using measures that support, motivate and enable people to work longer on the professional markets. The reading prism that we propose in this paper in the form of the tools of positional investment analysis and the concept derived from them, which enables the distinction between reforms and anti-reforms, will allow current events to be analysed, predicted and documented.

6. Summary and discussion

The tools of positional investment analysis, based on an extension of the Nash bargaining problem, have enabled us to provide, in the form of a concept, a basis for distinguishing between reforms and anti-reforms. Using this underpinning, it can be concluded that the current government in the Czech Republic has quite clearly taken the path of anti-reforms, resulting not only in a missed historical opportunity for the country, but also:

- A significant loss of economic efficiency.

- A rather drastic impact on certain groups of the population.

- An escalation of internal conflicts.

- Increasing the country's dependence on stronger partners, and thus the risk of continued discrimination.

There is a way forward. However, it can be expected to take time to open the way. One of the main conditions for a remedy is to increase the role of theory, which implies, among other things, the dissemination of the most important theoretically based findings to the professional and lay public.

The concept of differentiating reforms and anti-reforms in the context of defining prospective changes leading to the strengthening of the role of productive services makes it possible to analyse, document and predict developments in the field.

From the point of view of the current developments in the Czech Republic, it turns out to be important and topical to extend the model of distinguishing reforms and anti-reforms by the impact of anti-reforms on the narrowing of the space for negotiation and the associated escalation of conflicts. It then goes on to show the implications of this for the dilemmas faced by those who use positional investing and those who are affected by the consequences of positional investing. This is not an easy task, because the model must not be overly complicated, or its functionality is conditional on simplicity, clarity and an irreplaceable degree of elegance.

7. Conclusion

Analysing, monitoring and documenting developments in the Czech Republic, particularly in areas related to the changes being advocated in the pension system, can help a number of countries avoid the situation in which they find themselves. As this is a development that is almost a textbook example in terms of the relationship between theory and practice, it may also contribute to a greater influence of theory both in the Czech Republic itself and in other countries. Such an opportunity does not come along often; it is all the more important to make the most of it.

During the processing of this article over the past quarter of a year or so, the development trends in the Czech Republic discussed in the article have been confirmed. An interesting effect has occurred which may enter into economic theory. The attempt, in the form of anti-reforms in the pension system, to extract as many resources as possible for the benefit of those who use the option of positional investment has the effect of undermining confidence in the pay-as-you-go pension system, which, in an environment where there are many leakages from individuals' contributions to this system, leads to a decline in income to this system. The current government is trying to address this by further restrictions to the detriment of those affected by the consequences of the anti-reforms, leading to a further decline in confidence in the system and a further reduction in contributions to the system. We are currently witnessing a number of professional activities in the Czech Republic that are trying to document and analyse the situation from different angles. From the point of view of economic theory, including basic research, a number of new insights can be expected.